Are financial advisors recommending gold right now?

What 1,271 advisor–client meetings reveal about how gold’s surge is shaping client behavior

Gold is on a historic tear. Even after a mid-October pullback, it’s still up more than 51% year to date. For comparison, the S&P 500 is up 17.8%.

Context helps. From 1980 to 2000 the S&P 500 rose 2,593% while gold fell 44%.

Why the reversal now?

Depends on which outlet you’re reading. Some call it euphoria, others say it’s a hedge against inflation. I personally like Ben Carlson’s take.

Unsurprisingly, the run has produced daily headlines. Which got our team thinking: how much is gold showing up in advisor–client conversations, and what are the outcomes of those conversations?

2. Our analysis

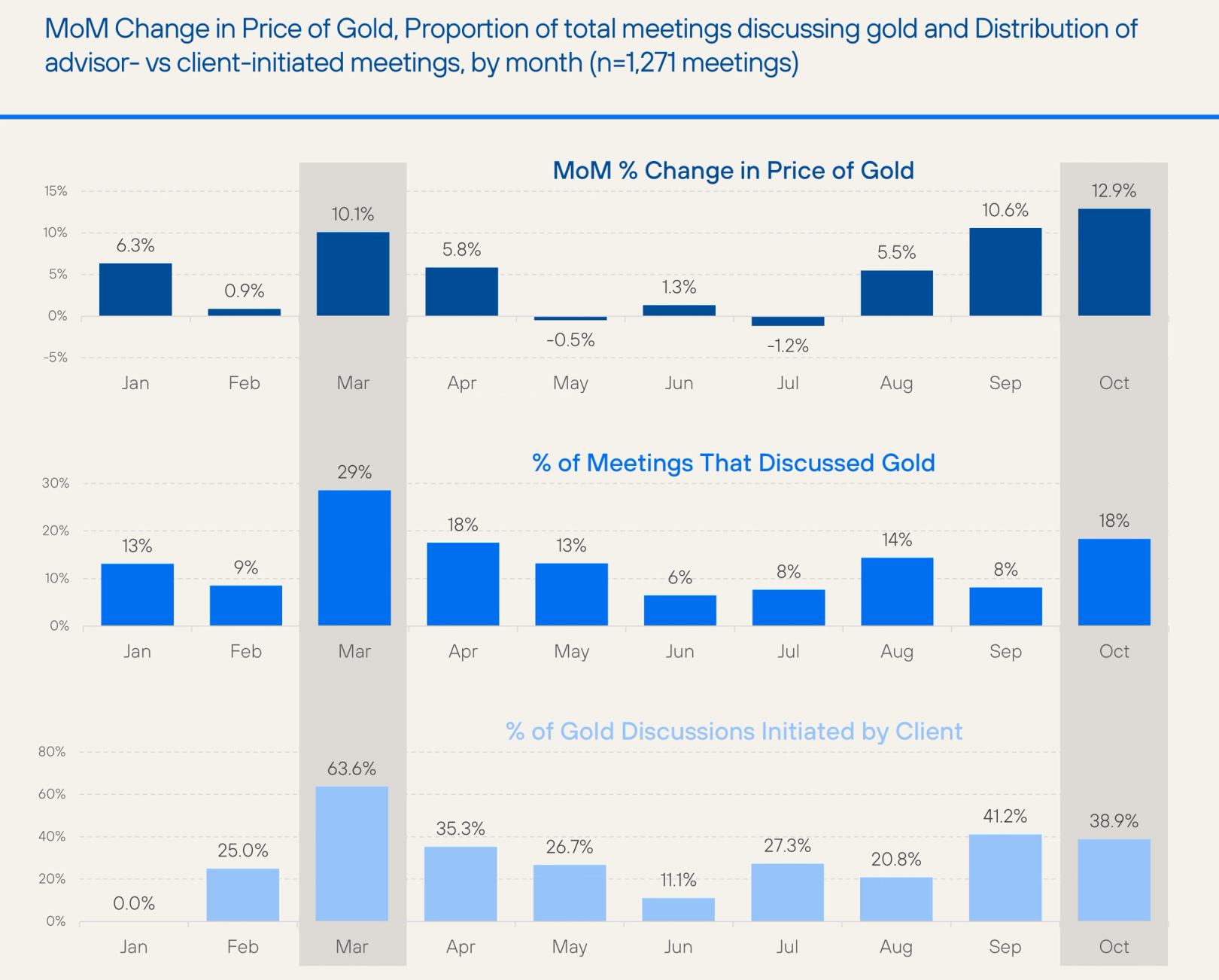

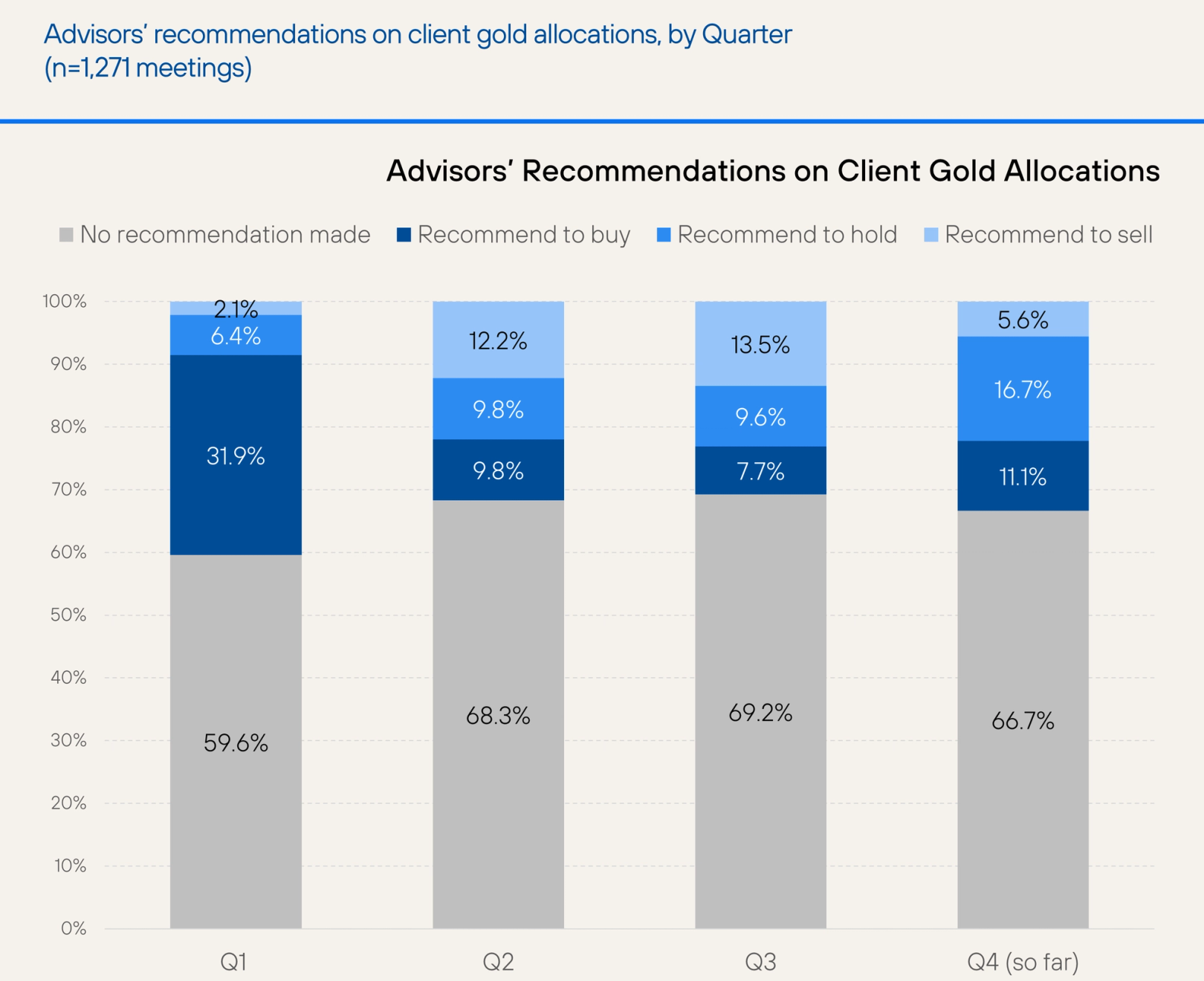

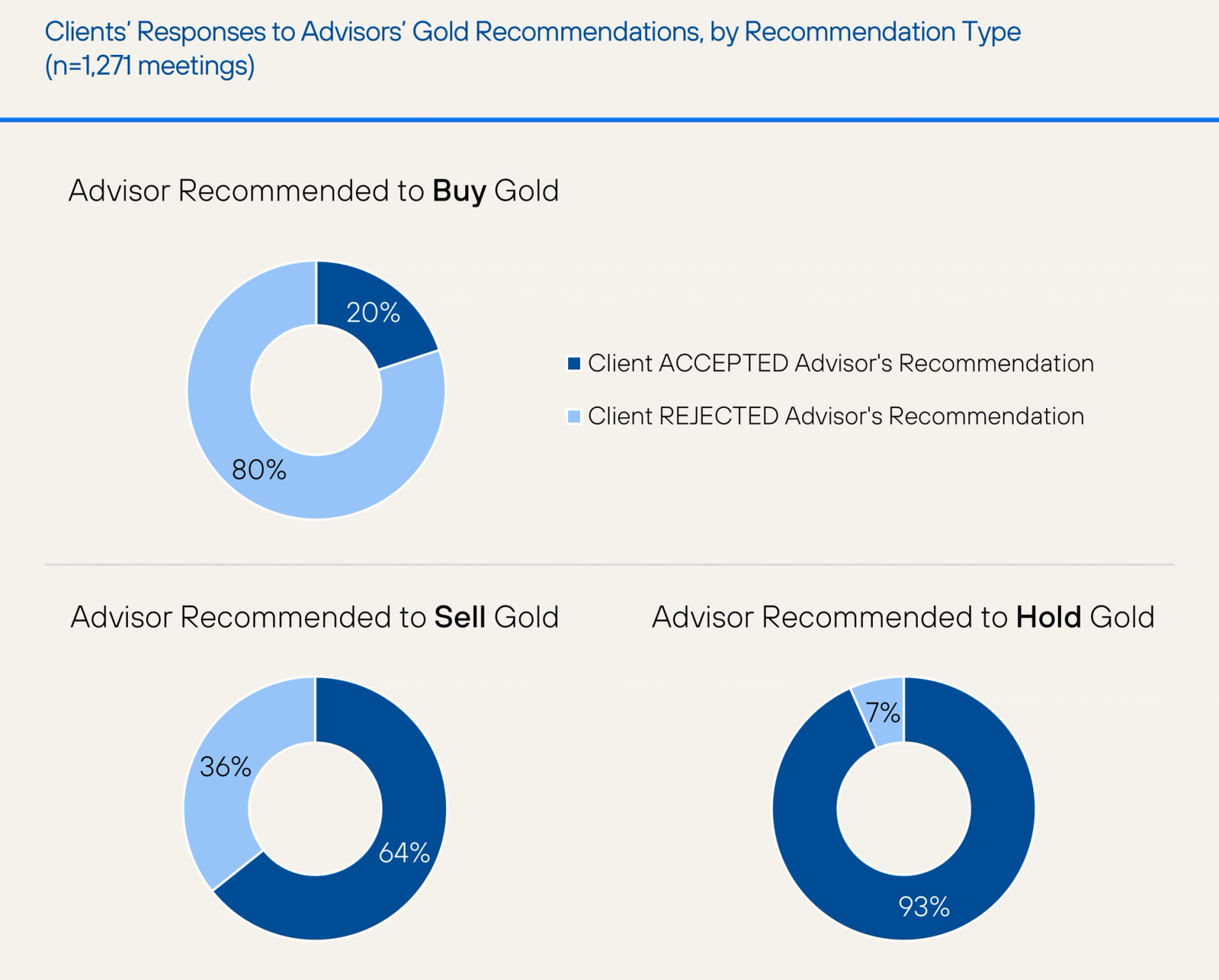

We reviewed 1,271 advisor-client meetings from January through October. For each meeting we recorded whether gold came up, who initiated the topic, what recommendation was made (buy, hold, sell, or no recommendation), and whether the client accepted it. We tracked gold mentions by month alongside price spikes, summarized recommendation mix by quarter, and calculated acceptance rates by action.

3. Our Findings

Takeaway 1: When gold rallies, clients bring it up.

In March, 29% of meetings discussed gold and about 64% of those conversations were client-initiated; through the first two weeks of October, 18% of meetings discussed gold and roughly 40% were client-initiated, showing renewed interest as prices surged again.

Takeaway 2: Advisor recommendations have shifted.

Early enthusiasm in Q1 gave way to caution in Q2 and Q3, when buy and hold calls fell, sell calls rose to the low-teens, and many meetings had no recommendation at all, then Q4 showed a turn with sells falling back and buys ticking up from midyear lows.

Takeaway 3: It is hard to get clients to actually buy gold.

Clients accepted about one in five buy recommendations, accepted nearly two thirds of sell recommendations, and accepted recommendations to hold more than nine times out of ten, highlighting how headline curiosity often translates into education rather than execution.

4. What this means for Advisors

Clients want to talk about gold, not necessarily buy it. Their curiosity usually isn’t a desire for exposure; it’s a search for why it’s surging and whether it will continue.

In this case, the truth will set you free: no one knows.

Still, these conversations create a valuable opening. When clients bring up gold, it’s a chance to pivot toward the fundamentals (e.g., diversification, risk balance, and long-term strategy). These are rarely the topics clients say they’re most interested in, but they’re the ones that ultimately matter most.

According to YCharts, only 21% of clients say they want to hear about how market events impact their financial plan, while 48% say they’re most interested in market trends and news. Gold sits right at that intersection, a “trend” that gives advisors permission to reconnect the conversation back to the plan.

In other words, the gold conversation isn’t about allocation, it’s about attention. A trojan horse for a meaningful conversation.